Forbes World’s Billionaires List 2025:

India solidified its position as a global economic powerhouse, housing 205 billionaires in the 2025 Forbes World’s Billionaires List, trailing only the U.S. and China. Despite a slight dip in collective wealth, the country’s elite continue to dominate global rankings, with Mukesh Ambani and Gautam Adani leading the pack.

India’s Billionaire Landscape: Key Highlights

- Total Billionaires: 205 (up from 200 in 2024).

- Combined Net Worth: 941billion(downfrom954 billion in 2024).

- Global Rank: 3rd, behind the U.S. (735 billionaires) and China (492 billionaires).

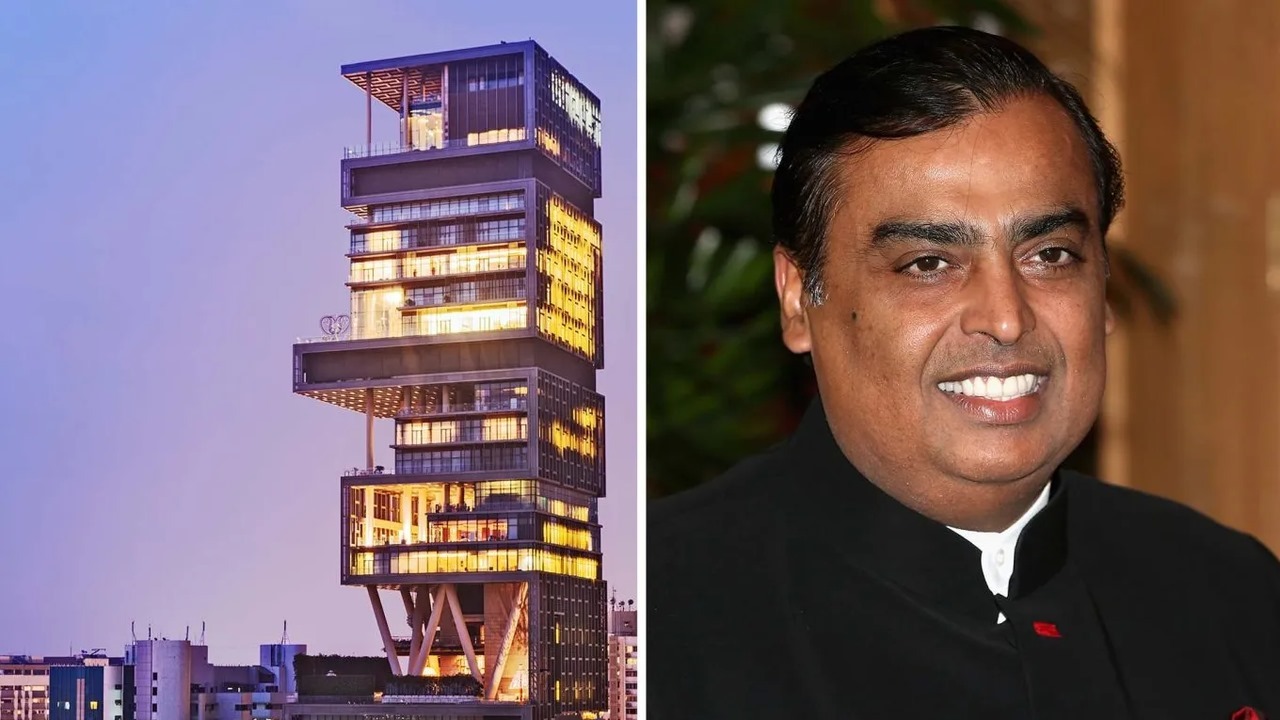

Mukesh Ambani: India’s Wealthiest, Despite $23.5B Drop

Mukesh Ambani, Chairman of Reliance Industries, retained his title as India’s richest person but saw his global rank slip from 9th to 18th due to a sharp decline in net worth:

- 2025 Net Worth: 92.5billion(downfrom116 billion in 2024).

- Primary Cause: Falling shares of Reliance Industries amid market volatility.

Gautam Adani: Second-Richest Indian Amid Challenges

Gautam Adani, head of the Adani Group, secured the second spot among Indian billionaires but faced significant setbacks:

- 2025 Net Worth: 56.3billion(downfrom77 billion in 2024).

- Global Rank: 48th, impacted by stock fluctuations in Adani Group companies.

Top 10 Richest Indians in 2025

- Mukesh Ambani: $92.5B (Reliance Industries)

- Gautam Adani: $56.3B (Adani Group)

- Savitri Jindal & Family: $35.5B (Jindal Steel & Power)

- Shiv Nadar: $34.5B (HCL Technologies)

- Dilip Shanghvi: $24.9B (Sun Pharmaceuticals)

- Cyrus Poonawalla: $23.1B (Serum Institute of India)

- Kumar Birla: $20.9B (Aditya Birla Group)

- Lakshmi Mittal: $19.2B (ArcelorMittal)

- Radhakishan Damani: $15.4B (Avenue Supermarts)

- Kushal Pal Singh: $14.5B (DLF Limited)

Global Billionaire Boom: Record Highs

The 2025 Forbes list shattered records:

- Total Billionaires: 3,028 (first time crossing 3,000).

- Combined Wealth: $16.1 trillion (up 7% from 2024).

- Top Global Billionaire: Elon Musk (342B),followedbyBernardArnault(245B) and Jeff Bezos ($198B).

Why India’s Wealth Dipped?

- Market Volatility: Reliance and Adani Group shares faced headwinds, eroding $20B+ from Ambani and Adani’s fortunes.

- Regulatory Shifts: Stricter ESG norms and geopolitical tensions impacted conglomerate valuations.

The Bigger Picture

India’s billionaire count growth reflects its thriving tech, pharma, and renewable energy sectors. However, wealth concentration remains a debate, with the top 10 Indians controlling over 25% of the country’s total billionaire wealth.

Final Takeaway:

While India’s ultra-rich navigate market turbulence, their global influence continues to rise. For more insights on wealth trends and rankings, stay tuned to Forbes’ annual updates.

Disclaimer

- Data Source: This article is based on Forbes’ publicly released 2025 Billionaires List. Figures are approximate and subject to stock market fluctuations.

- Net Worth Estimates: Wealth calculations reflect Forbes’ methodology and may differ from other publications.

- Not Financial Advice: This content is for informational purposes only. Consult a financial advisor before making investment decisions.

- Dynamic Rankings: Billionaire rankings change frequently; verify updates from Forbes directly.

- Third-Party Links: This article is not affiliated with Forbes or the individuals mentioned.

FAQ: Forbes 2025 Billionaires List

1. Why did Mukesh Ambani’s net worth drop?

Ambani’s wealth fell due to a decline in Reliance Industries’ share price, driven by slower growth in Jio’s telecom segment and rising competition in retail.

2. How does India rank globally?

India is 3rd, behind the U.S. (735 billionaires) and China (492).

3. Who are the fastest-rising Indian billionaires?

- Cyrus Poonawalla (Serum Institute): Gained $3B due to vaccine demand.

- Savitri Jindal (Steel & Power): Wealth rose 12% with infrastructure growth.

4. Why did Gautam Adani’s ranking fall?

Adani Group faced investor skepticism post-Hindenburg allegations, impacting stock valuations.

5. Which sectors created the most Indian billionaires?

- Pharma (e.g., Dilip Shanghvi).

- Renewable Energy (e.g., Green Adani ventures).

- Tech & Retail (e.g., Shiv Nadar, Radhakishan Damani).

6. How many new billionaires joined India’s list?

5 new entrants, including Nykaa’s Falguni Nayar and Zomato’s Deepinder Goyal.

7. What is the global billionaire trend?

A record 3,028 billionaires (up 6% from 2024), fueled by AI, space tech, and luxury markets.

Etiler su kaçak tespiti Önleyici bakım, büyük su hasarı onarımlarından daha ucuzdur. https://pmrczambia.com/?p=12099

Кайт сафари красное море

изготовление пинов В мире, где детали определяют имидж, значки на пиджак становятся не просто аксессуаром, а мощным инструментом самовыражения. Заказать металлические значки – значит подчеркнуть свою индивидуальность и принадлежность к определенному сообществу.

купить аккаунт с прокачкой продажа аккаунтов соцсетей

продажа аккаунтов соцсетей https://marketplace-akkauntov-top.ru

Развитие бизнеса Как развивать лидерские качества? Лидерские качества важны для качественного управления бизнесом. Начните с самоанализа: определите свои сильные и слабые стороны. Читайте книги о лидерстве, посещайте тренинги и семинары. Практикуйте активное слушание, учитесь делегировать задачи. Вдохновляйте свою команду и создавайте атмосферу доверия. Развивая лидерские качества, вы будете эффективно управлять и мотивировать свою команду.

магазин аккаунтов магазин аккаунтов

Яндекс инвайт Яндекс – это не просто поисковая система, это целая экосистема, пронизывающая все сферы нашей цифровой жизни. И ключом к максимуму возможностей этой экосистемы является Яндекс Плюс. Но как получить этот заветный ключ? Ответ прост – Яндекс Инвайт. Инвайт – это персональное приглашение, открывающее доступ к премиальным функциям и эксклюзивным предложениям Яндекс Плюс. Это ваш шанс на год забыть об ограничениях и наслаждаться всеми преимуществами подписки.

магазин аккаунтов профиль с подписчиками

купить аккаунт площадка для продажи аккаунтов

безопасная сделка аккаунтов маркетплейс аккаунтов соцсетей

покупка аккаунтов маркетплейс аккаунтов

преобразователь частоты для скважинного насоса Установка и Настройка Частотного Преобразователя Установка частотного преобразователя требует профессионального подхода. Необходимо обеспечить правильное подключение к электросети, настроить параметры работы насоса и предусмотреть защиту от перегрева и влаги.

Гибкий камень

Гибкий камень – это инновационный отделочный материал, сочетающий в себе эстетику натурального камня и удобство в применении. Изготавливается он путем нанесения тонкого слоя песчаника на текстильную основу. Благодаря этому, материал обладает гибкостью и легкостью, что позволяет использовать его для облицовки поверхностей любой сложности, включая криволинейные участки.

Гибкий мрамор

Гибкий мрамор представляет собой аналог гибкого камня, но в качестве основы используется мраморная крошка. Этот материал отличается более изысканным внешним видом, имитируя текстуру и цвет натурального мрамора. Гибкий мрамор применяется для создания элегантных интерьеров, облицовки каминов, колонн и других декоративных элементов.

Облицовка стен

Облицовка стен гибким камнем и мрамором – это современное решение для создания уникального дизайна интерьера и экстерьера. Материалы легко режутся и монтируются, не требуют специальной подготовки поверхности. Они устойчивы к перепадам температур, влаге и механическим повреждениям. Благодаря разнообразию цветов и текстур, гибкий камень и мрамор позволяют реализовать любые дизайнерские идеи, от классики до модерна. Облицовка стен этими материалами придает помещению неповторимый стиль и создает атмосферу комфорта и уюта. гибкий мрамор

Website for Selling Accounts Marketplace for Ready-Made Accounts

Account market Guaranteed Accounts

Find Accounts for Sale Account Buying Service

Account Sale Account Trading Platform

When stacked, they attack power improvement from multiple angles — leading to faster, extra noticeable gains in energy,

endurance, and muscle high quality. All 4 steroids within the strength stack are

fast-absorbing oral steroids. Although recognized for power, D-Bal

additionally triggers noticeable will increase in muscle

mass. Of weight acquire throughout a full cycle, relying on food plan and training intensity.

Not Like bulking-only compounds, strength-focused oral steroids are designed to boost

explosive lifting energy, muscular endurance, and training restoration — all without the necessity for injections or

unlawful substances. Post-cycle therapy (PCT) is a crucial step after finishing a Dianabol and

Testosterone cycle.

The Ghrelin sign is combines with the growth hormone releasing hormone and somatostatin to regulate

the timing and degree of progress hormone secretion. Human Development hormone also stimulates triglyceride hydrolysis in adipose tissue, which often produces notable fats

loss throughout utilization of HGH. HGH additionally

increases glucose output in the liver, and stimulates insulin resistance by blocking the exercise

of this hormone in those particular targeted cells. HGH increases absorption of protein and

other macro/micro nutrients, it also hastens the metabolism quick sufficient to begin burning fats.

The largest factor you’re in all probability serious about is, “Do I go with orals or injectables? Orals are no doubt a lot less daunting than injecting for the first time, however it does significantly limit the compounds you’ll be ready to use, plus how lengthy you’ll be succesful of use it. Whereas orals are simpler to take, they come with toxic unwanted facet effects to the liver. Steroid biking is utilized by individuals who know precisely what they wish to obtain and when, as well as once they wish to be steroid-free in phrases of being tested. Some anabolic steroids are available an injectable kind solely, whereas others can be found in an oral type. Few, corresponding to Winstrol and Primobolan, could be injected or taken orally.

Thousands of experiences, comments, and reviews are written yearly by guys utilizing HGH. One exception – when bunk HGH is used (and that happens often), results will be disappointing. But you go into HGH anticipating that, and that’s why we try to buy the good stuff or don’t bother at all.

Pharmacies in several countries are legally in a position to sell Sustanon 250 and different steroids to clients and not using a prescription. Critical bodybuilders may determine to go to these nations because of the easier method of buying steroids, however attempting to return to the US along with your anabolic steroids will again put you susceptible to the legislation. Sustanon 250 is deemed secure for its supposed medical use in treating low testosterone circumstances in males. When it comes to utilizing Sustanon 250 for performance functions and at high doses, it’s never attainable to declare it completely protected. This rapid mass-gaining stack makes use of Anadrol for the primary three weeks only (it is not really helpful to make use of it longer as a result of strong liver toxicity!).

Deca Durabolin’s lack of androgenicity is brought on by the reduction of dihydronandrolone (DHN) quite than dihydrotestosterone (DHT). The benefit of much less DHN is fewer instances of hair loss, pimples, and enlargement of the prostate gland. Nonetheless, Deca Durabolin is usually stacked with other toxic steroids, exacerbating blood lipids. Consequently, we do not discover fats loss to be notable on Deca Durabolin due to its reducing CPTI (carnitine palmitoyltransferase I) expression and thus inhibiting fats metabolism. Such adverse results can linger for several months; nonetheless, with an aggressive PCT, they could solely final for several weeks. We have discovered Trenbolone to cause paranoia and anxiety in delicate customers through its stimulation of the central nervous system and thus shifting the body into fight-or-flight mode.

It’s essential to adhere to legal regulations,especially in the United Kingdom where using anabolic steroids without aprescription is illegal. Hormone optimization may additionally be exploredthrough life-style modifications and doubtlessly with the guidance of a qualifiedhealthcare skilled. Optimizing hormone ranges can help muscle development,restoration, and total well-being. Strategies for hormone optimization mayinclude maintaining a wholesome physique weight, partaking in regular physicalactivity, reducing stress, and making certain enough sleep. In some cases, hormonereplacement remedy (HRT) beneath medical supervision may be thought of toaddress specific hormone deficiencies or imbalances. Regular medical check-ups and monitoring bya qualified healthcare professional are essential for older adults engaging insteroid cycles.

It’s straightforward for different people to see a giant and muscular dude walking down the street and routinely assume he’s on steroids. The research is hard to understand, and even more durable to search out, but it is considerably apparent that exogenous Testosterone seems to decrease bodily levels of Zinc considerably. Zinc can subsequently perhaps (really maybe) slightly amplify the benefits of Steroids.

Many legal steroids on the market are great at selling size — but not all of them ship brute energy. Whereas compounds like Deca Max are excellent for constructing high quality muscle, they don’t essentially improve muscle output or power production. D-Bal has earned its title as essentially the most iconic legal steroid various within the health world. In this guide, we break down the top legal oral steroids for power, revealing how they work, what sets every aside, and which one is greatest suited for your training targets.

It won’t deliver a few complete shutdown by itself, however you’ll must add a testosterone steroid to any Winstrol cycle because low testosterone is a certainty in any other case. PCT is a must-do after utilizing Winstrol to get your testosterone perform again on observe. This makes the hair from each follicle thinner and shorter; over time, the follicle dies, which suggests no extra hair progress.

Her response is a criticism of the current disease-based health care system, which focuses on healing the sick rather than preserving the wholesome. However if his research seems to be successful, it may usher in a new era of higher, faster restoration from sports activities injuries. HGH surges during childhood and adolescence, however by the point you’re forty, you’re producing only about half as much as you have been at 20. Neither the authors nor the publisher are responsible for any damages or losses which will occur from using data supplied on this site.

Beware that combining Tren and Halo can lead to severe mood, sleep, and aggression changes. Halotestin has some fairly specific uses, and it won’t be a steroid you utilize only for the hell of it. You’ll need to be confident about WHY you’re using it and the way to slot it right into a cycle finest. However even using Halo for competition prep nonetheless requires a testosterone base, so running a “Halo-only” cycle isn’t really helpful. Halo may assist stimulate the production of erythropoietin8, a hormone important in the manufacturing of pink blood cells9. This not only contributes to the unbelievable energy results of Halotestin but also to its glorious capacity to improve stamina, energy, and endurance.

References:

bob paris steroids

These steroids play an integral part in sustaining hormonal stability, regulating estrogenic activity,

and ensuring general well-being through the cycle’s duration.

Therapy strategies might embrace using drugs including aromatase inhibitors that block testosterone from converting to estrogen and SERMs,

which assist decrease levels of estrogen. Steroid use can be important to any steroid

methodology as it enables safer, more practical outcomes.

This is why such users will aim to make use of high doses proper before a

contest, to attain maximum muscle definition and dryness after which ideally enable the

physique to get well with out steroids afterward. Winstrol will promote strength gains at a degree that

may be stunning, especially once we think about it as a slicing steroid.

Sustaining power while dieting is crucial, but Winny can significantly improve power past primary

upkeep. I’ve heard of people describing their power gains with Winstrol as being just

like a steroid like Trenbolone in some instances. Both types of Winny (oral and injectable) contain a methyl

group attachment at the 17th carbon, making them C17-aa

steroids that can resist liver metabolism. Like all DHT-derived steroids and DHT itself, Winstrol can’t bind to

the aromatase enzyme, which suggests it can not convert to estrogen like testosterone-based steroids.

Though most anabolic steroid users choose to take Winstrol in tablet type, there are some advantages to the injection.

A lengthy course of administration results in an enchancment in muscle definition, burning

of subcutaneous fat and an increase in power indicators.

Remember, managing unwanted effects is a proactive course

of that requires accountable use, open communication with healthcare professionals, and self-awareness.

By prioritizing your well being, monitoring your body’s response, and looking for steerage when needed, you’ll find a way to minimize dangers and optimize the advantages of Anavar usage.

Always prioritize accountable use, educate your self about potential risks and precautions, and seek skilled steerage to ensure

a secure and effective Anavar cycle. Related to the beginner cycle, splitting the every day dosage

into two administrations is recommended to maintain stable

blood levels. During the cycle, it is advisable to separate the every day dosage into two equal administrations,

one in the morning and one in the evening, to take care of secure

blood ranges. Anavar additionally has a fat-burning impact, as it could possibly increase metabolic fee and target

visceral fat.

Those who supplement with Anavar during the cutting phase may even burn fat at

a more environment friendly fee. Regardless of how highly effective the direct lipolysis trait is or isn’t, the metabolic rate will still be significantly enhanced.

Once lean, the person will also discover he appears harder and extra outlined.

This is usually accompanied by enhanced vascularity, and an overall tighter look.

In addition to this, you want to watch out for black market dealers that declare to offer actual steroids when all they sell are fake,

adulterated medication.

These compounds start working rapidly, thus making it attainable to achieve fast features.

We should embrace this as either a primary or supportive compound in every

steroid cycle as a outcome of the steroids you’re

taking ship a sign to the testes that they not need to produce testosterone.

All sensible steroid users will, without question, include

this sex hormone in every cycle because of this alone, on the very least.

Your body naturally produces a particular amount of T3, so when you take less

than that amount, you’ll go backward and become deficient in this hormone.

The muscle-boosting benefits of steroid drugs

are self-explanatory. What you might not have known is that anabolic drugs are additionally

phenomenal for your endurance. Alright this

isn’t a Complement, I know I’m dishonest, however cardio is

free! Cardio can do every thing, decrease blood

stress, decrease ldl cholesterol, enhance insulin sensitivity, cut back inflammation, and (from personal experience) helps your

breath better! Better respiratory means higher sleep which… nah you know the way necessary that is (hopefully).

The two main organs to support and look after while on cycle are the kidneys and the liver.

These might be placed beneath nice stress, and while the liver is type of robust and will

recover beneath, the kidneys will not.

There are two types of steroids, namely oral and injectable steroids.

The finest oral testosterone dosage for newbies and advanced bodybuilders is four hundred mg taken every day for multiple month.

It is essential to note that these dosage

recommendations are general tips and particular person responses may range.

Components similar to age, gender, body weight, and previous

expertise with anabolic compounds should be considered.

Consulting with a healthcare professional or experienced

health advisor is extremely recommended to tailor the length and dosage to

your specific wants. It is price noting that intermediate and advanced Anavar

cycles typically extend past eight weeks, ranging from 10

to 12 weeks. However, the precise length ought to be based on individual goals, expertise, and

overall health.

Mainly, if you want a steroid that will make you big, lean, powerful, and

masculine, with out having to worry about Gynecomastia, and different Androgenic side effects, Deca

could probably be your drug of selection. Unwanted Side Effects from

Testosterone are an increase in Blood Strain, Ldl

Cholesterol Points, Endogenous Testosterone shutdown, and potential hair loss.

Here at Steroids.Click, you should purchase Oral Steroids in the USA with confidence.

5mg of either type is the same quantity – what does differ is how rapidly they’re absorbed and used up by the body, which is mirrored in their half-lives listed above.

No matter which country you reside in or which product you purchase,

our dependable delivery service ensures delivery within a quantity of days.

Our staff is committed to offering customers with exceptional customer support and responding quickly to any queries or questions they may have

earlier than they place their orders. We are committed to serving to athletes reach their highest potential

by providing them with high-quality, secure steroids at an affordable price.

By following the following pointers, you’ll find a way to enhance your chances of acquiring a reliable and secure Anavar product.

Please note that particular person experiences might vary, and

you will need to exercise caution and consult with professionals when making purchasing choices.

We sincerely hope to give you a smoother experience on your next orders.

Your satisfaction with the standard of the

items and the discretion of the packaging is much appreciated.

Oral steroids are mainly metabolised by either your liver

or kidneys and some oral steroids are extra hepatotoxic than others.

Oral steroids can be utilized by athletes on the lookout for either bulking or cutting features.

They may also be utilized by athletes looking to enhance their athleticism.

Nonetheless, as a end result of methyltrienolone’s high toxicity, even in modest dosages, bodybuilders hardly ever use it and prefer injectable

trenbolone instead.

This is a low dose, however each additional milligram a feminine takes of Winny does make

an enormous distinction and runs the chance of taking you from a tolerable cycle to 1 where virilization begins

to creep in. In that case, you’re not prone to see much of Winstrol’s hardening or different results,

and you’d be higher off working a longer cutting or fat-burning cycle earlier than considering Winny.

Whereas it’ll typically be included within the last

portion of a longer cycle stack, Winny’s use must be limited to 6 or eight weeks.

References:

steroid alternative supplements – Justin,

Account Sale Find Accounts for Sale

Accounts marketplace Account Trading Platform

Purchase Ready-Made Accounts buyagedaccounts001.com

Sell Account Account trading platform

Сервис video2dn становится еще более популярным благодаря простоте использования и своей удобной функциональности. Он обеспечивает надежную загрузку видео без угроз для устройства. Более детальную информацию вы отыщите на нашем ресурсе. Ознакомьтесь с ответами на часто задаваемые вопросы. https://video2dn.com – тут есть возможность просто произвести скачивание видео с youtube. Video2dn хорошо работает на различной платформе, которая у вас есть: компьютер, телефон, либо планшет. Вам торренты больше не нужны! Интересный контент уже вас ждет!

Account Store Accounts for Sale

Accounts for Sale Find Accounts for Sale

Database of Accounts for Sale Verified Accounts for Sale

Арвес Маркет: Ваш Надежный Партнер в Мире Велосипедных Запчастей и Аксессуаров

В динамичном мире велосипедной индустрии, где инновации и качество играют ключевую роль, «Арвес Маркет» занимает прочные позиции лидера, предлагая широкий ассортимент велосипедных запчастей и аксессуаров как оптом, так и в розницу. Наша миссия – обеспечить каждого клиента надежными, долговечными и современными решениями для его велосипеда, будь то профессиональный спортсмен, опытный велотурист или начинающий любитель.

Ассортимент, Вдохновляющий на Приключения:

В «Арвес Маркет» вы найдете все необходимое для обслуживания, ремонта и тюнинга велосипеда любой модели и уровня. От высокотехнологичных компонентов трансмиссии и тормозных систем до эргономичных сидений и стильных аксессуаров, каждый продукт проходит строгий контроль качества и соответствует самым высоким стандартам. Мы сотрудничаем с ведущими мировыми производителями, чтобы предложить вам передовые разработки и проверенные решения.

Оптовые Поставки: Гарантия Выгодного Сотрудничества:

Для владельцев веломагазинов, мастерских и сервисных центров «Арвес Маркет» предлагает выгодные условия оптовых поставок. Наша гибкая ценовая политика, оперативная логистика и индивидуальный подход к каждому клиенту позволяют нам строить долгосрочные и взаимовыгодные партнерские отношения. Мы гарантируем стабильность поставок, широкий выбор продукции и профессиональную поддержку на всех этапах сотрудничества.

Розничная Торговля: Персональный Подход к Каждому Велосипедисту:

В розничных магазинах «Арвес Маркет» вас встретят квалифицированные консультанты, готовые помочь с выбором запчастей и аксессуаров, учитывая ваши индивидуальные потребности и предпочтения. Мы предлагаем не только широкий ассортимент продукции, но и профессиональные консультации по обслуживанию и ремонту велосипеда, помогая вам продлить срок его службы и получить максимальное удовольствие от катания.

Присоединяйтесь к Сообществу «Арвес Маркет»!

«Арвес Маркет» – это не просто поставщик велосипедных запчастей и аксессуаров, это ваш надежный партнер в мире велоспорта и активного отдыха. Мы стремимся сделать катание на велосипеде доступным, комфортным и безопасным для каждого. Присоединяйтесь к нашему сообществу, и вместе мы откроем новые горизонты! https://arvesmarket.ru/

Эффективное продвижение на Авито сегодня невозможно без учета поведенческих факторов (ПФ). Простой тест, запущенный с нулевым бюджетом, может показать, насколько важна грамотная оптимизация объявлений. Игнорирование ПФ – это упущенная возможность привлечь внимание потенциальных клиентов и увеличить продажи.

Вопрос, стоящий перед многими продавцами: стоит ли прибегать к накрутке лайков, просмотров и контактов ради искусственного повышения рейтинга? Ответ неоднозначен. Да, первоначальный толчок может быть обеспечен, но долгосрочная стратегия должна строиться на органическом росте и реальной заинтересованности пользователей. Иначе, алгоритмы Авито быстро распознают неестественную активность и применят санкции.

Вместо сомнительных методов, лучше инвестировать в качественный контент и продуманное оформление объявлений. Фотографии высокого разрешения, подробные описания, релевантные ключевые слова – вот основа успешного продвижения.

Не стоит забывать и о курсах обучения. Инвестиции в знания и навыки по работе с платформой Авито окупятся многократно. Грамотное использование инструментов продвижения, аналитика результатов и постоянная оптимизация позволят не только привлечь больше клиентов, но и значительно повысить ROI. В конечном итоге, стратегия, основанная на органическом росте и качественном контенте, всегда окажется более эффективной и долгосрочной, чем искусственная накрутка. Даже вложив всего 1 рубль в правильные инструменты, можно добиться значительного прогресса. пф авито что значит

secure account sales sell account

buy pre-made account marketplace for ready-made accounts

account trading socialaccountssale.com

accounts for sale account trading platform

account sale ready-made accounts for sale

buy and sell accounts accounts market

account market buy accounts

account market sell accounts

guaranteed accounts social media account marketplace

online account store account purchase

secure account purchasing platform buy and sell accounts

sell accounts account exchange service

accounts for sale accounts marketplace

online account store verified accounts for sale

profitable account sales profitable account sales

buy accounts secure account sales

buy account account store

database of accounts for sale social media account marketplace

accounts market verified accounts for sale

account selling service sell accounts

profitable account sales account market

accounts market purchase ready-made accounts

verified accounts for sale account buying platform

account acquisition account marketplace

website for buying accounts account buying platform

buy account buy pre-made account

sell accounts secure account sales

accounts market https://accounts-offer.org

online account store https://accounts-marketplace.xyz

account catalog https://buy-best-accounts.org

account trading platform https://social-accounts-marketplaces.live

account trading service accounts marketplace

account market https://social-accounts-marketplace.xyz

accounts market https://buy-accounts.space/

account market https://buy-accounts-shop.pro/

purchase ready-made accounts https://accounts-marketplace.art

account store https://social-accounts-marketplace.live

buy accounts https://buy-accounts.live

social media account marketplace https://accounts-marketplace.online

website for selling accounts https://accounts-marketplace-best.pro

покупка аккаунтов https://akkaunty-na-prodazhu.pro

маркетплейс аккаунтов rynok-akkauntov.top

магазин аккаунтов https://kupit-akkaunt.xyz/

продажа аккаунтов akkaunt-magazin.online

площадка для продажи аккаунтов akkaunty-market.live

продать аккаунт kupit-akkaunty-market.xyz

маркетплейс аккаунтов akkaunty-optom.live

маркетплейс аккаунтов соцсетей https://online-akkaunty-magazin.xyz

продать аккаунт akkaunty-dlya-prodazhi.pro

купить аккаунт kupit-akkaunt.online

facebook ad account for sale https://buy-adsaccounts.work/

facebook ads account buy buy facebook ads account

buy fb ads account https://buy-ad-account.top

buy facebook advertising accounts fb accounts for sale

cheap facebook advertising account https://ad-account-buy.top/

facebook ad account buy buy facebook account

buy fb ads account https://ad-account-for-sale.top

buy fb ad account https://ad-accounts-for-sale.work

google ads agency account buy https://buy-ads-account.top

google ads accounts for sale https://buy-ads-accounts.click

cheap facebook account https://buy-accounts.click

buy verified google ads account https://ads-account-for-sale.top

buy verified google ads account https://ads-account-buy.work

buy google ads agency account https://buy-ads-invoice-account.top

buy google ads accounts buy google ads invoice account

buy adwords account google ads account seller

buy google agency account https://sell-ads-account.click

Personnellement, j’ai intégré 10 minutes de méditation guidée chaque

matin. Une meilleure gestion du stress et une énergie décuplée tout au long de la

journée. Testo Prime se distingue par sa combinaison d’ingrédients naturels cliniquement prouvés pour soutenir la testostérone.

Cette formulation synergique inclut des éléments comme l’extrait d’Ashwagandha KSM-66®,

le Panax Ginseng, et d’autres nutriments essentiels pour maximiser l’efficacité.

Vous pouvez sans problème manger des noix,

des cacahuètes ou des noix de brésil, et d’autres fruits secs

en grande quantité. Avec un tel régime alimentaire, votre corps devra rapidement produire de

la testostérone.

Le lien entre le poids corporel et les niveaux de testostérone est un sujet d’importance croissante dans la

recherche sur la santé masculine. Plusieurs études

ont démontré que l’obésité peut avoir un impression significatif sur les niveaux de testostérone, soulignant l’importance de la gestion du poids pour maintenir

un équilibre hormonal sain. Simultanément, la diminution de la

production de testostérone fait partie de la dégradation de

l’état de santé. Des études ont démontré que la durée et la qualité de

sommeil influent directement sur le taux de testostérone au réveil.

La testostérone est encore bien souvent associée à la

virilité et convoitée par de nombreux sportifs pour augmenter leur masse musculaire et améliorer leurs performances sportives.

Au contraire, cela augmente le taux de cortisol ou hydro-cortisone qui est la trigger du blocage de la sécrétion de l’hormone mâle.

Le temps idéal pour une bonne production est les entrainements à courte durée, voir 1 minute.

Cependant, l’intensité des exercices de musculation permettent vraiment la stimulation de la testostérone.

Les répétions forcées, les drop-sets, les répétitions partielles sont les méthodes à pratiquer pour booster la testostérone.

Les séances de HIIT cardio OU Haute Intensité Intervalle Coaching sont également très conseillées.

La libido correspond à l’envie et la volonté d’avoir

une activité sexuelle, y compris la masturbation. Le désir sexuel

fluctue tout au long de la vie et, parfois, les hommes peuvent souffrir

d’une baisse de libido. L’essentiel de cette hormone est produite pendant

les phases de sommeil profond, notamment en début de nuit.

Évitez les aliments ultra-transformés, riches en sucres ajoutés et en mauvaises graisses, qui perturbent l’équilibre hormonal.

Contrairement à ce que l’on pourrait penser, notre corps n’a pas besoin de

caféine pour avoir de l’énergie.

Le stress est l’un des principaux facteurs de la baisse de testostérone, automotive il provoque la manufacturing de cortisol.

En réduisant les niveaux de cortisol, l’ashwagandha permet

à votre corps de mieux produire de la testostérone.

Ce complément est particulièrement recommandé pour les personnes qui sont souvent soumises à des situations

stressantes. Le pyrèthre d’Afrique, aussi appelé Tribulus Terrestris,

est une plante utilisée depuis des siècles pour améliorer

la santé sexuelle et la vitalité. Il est particulièrement populaire pour son rôle dans l’augmentation de la testostérone.

En effet, cette plante a montré des résultats positifs en termes

d’amélioration de la libido et de stimulation de la production de testostérone.

De plus, elle favorise la santé du cœur et des muscular tissues, ce qui en fait un choix polyvalent.

Comme l’explique , cette hormone influence également l’humeur, la motivation, la capacité

à gérer le stress et la clarté mentale. Lorsqu’elle est steady, elle favorise une pensée plus

structurée, une meilleure gestion des émotions et une vie sexuelle plus

épanouie. Elle stimule le désir, renforce l’estime de soi et participe à

une sensation générale de bien-être, sans excès ni caricature, mais avec un retour à une harmonie naturelle entre le corps et l’esprit.

Si vous cherchez à augmenter naturellement vos niveaux de testostérone, vous êtes au bon endroit.

De nombreux compléments alimentaires peuvent vous aider à atteindre cet objectif.

Dans cet article, nous vous dévoilons sept compléments

naturels que nous vous recommandons pour stimuler la production de testostérone.

En adoptant ces suppléments, vous pourrez maximiser vos résultats tout en préservant

votre santé.

Limitez cependant vos séances à minutes afin d’éviter l’augmentation du cortisol,

hormone antagoniste de la testostérone. Adopter une approche holistique orientée

sur la santé générale est essentiel. Allier les différentes stratégies discutées améliore les résultats globaux.

En intégrant l’alimentation, l’exercice, la gestion du stress et le sommeil, vous

pouvez donner un coup de pouce significatif à votre taux de testostérone.

Elle influe sur la libido, l’énergie, la masse musculaire, la distribution des graisses, et

même l’humeur. Alors, remark peut-on augmenter naturellement ses niveaux de testostérone pour améliorer sa qualité de vie?

C’est la question que se posent de nombreux hommes qui cherchent à optimiser leur

potentiel, que ce soit d’un level de vue physique, mental ou sexuel.

Effectivement lorsque j’ai suivi ces méthodes,

j’en ai obtenu d’excellents résultats, surtout en musculation. J’ai aussi gagné plus de confiance en moi, ce

qui m’a rendu plus épanoui dans ma vie et prêt à relever

tous les défis que je me lance au quotidien. Nous vous conseillons d’opter pour un supplément d’ashwagandha

de qualité pour bénéficier de ses effets positifs sur vos

niveaux de testostérone et votre bien-être

général. Pour résumer, si vous souhaitez booster votre

testostérone naturellement, il est conseillé de dormir entre 7h et 9h

par nuit. Oui, une consommation excessive d’alcool peut avoir un impact négatif sur le taux de testostérone.

Pour la santé, le sommeil est au moins aussi essential que la qualité de son alimentation et son activité sportive.

Le mieux pour comprendre le reste de l’article est de faire

un petit rappel sur la testostérone. Le ginseng, notamment le ginseng rouge, revigore grâce à

ses propriétés bien connues. Des recherches

suggèrent que le ginseng pourrait augmenter les niveaux de

testostérone Basse Femme et améliorer la fonction sexuelle.

La testostérone, souvent perçue comme le symbole de la masculinité, est bien plus qu’une simple

hormone liée à la virilité. C’est une hormone stéroïdienne, principalement produite dans les testicules chez

les hommes et, dans une moindre mesure, dans les ovaires chez

les femmes.

buy old google ads account https://buy-verified-ads-account.work/

buy business manager facebook https://buy-business-manager.org

google ads accounts for sale google ads agency accounts

Der Fähigkeit, Wärme zu erzeugen, um Stoffwechselreaktionen wie Lipolyse,

Katabolismus oder Fettverbrennung durchzuführen. Wenn wir von Genotyp sprechen, beziehen wir uns auf Ihre individuelle und persönliche genetische

Veranlagung. Das heißt, die Gene, die Sie von Ihren Eltern geerbt haben. Andererseits lassen sich Umweltfaktoren durch Ihre Trainingsroutinen und Ihr Vorbereitungsniveau verändern. Egal, ob Sie ein fortgeschrittener oder professioneller Sportler sind, CrossDNA Skilled wird Ihnen helfen,

Ihr Coaching zu optimieren und Ihnen wichtige Informationen geben, um zu wissen, wo Ihre Grenzen liegen und wo nicht.

Entdecken Sie viele Aspekte, die Sie nicht über sich selbst wussten, mit nur einer

Speichelprobe.

Daher ist es wichtig, immer die Seite mit den Details zu beachten. Die Größe des Bewertungsbalkens ist proportional zur Relevanz der Auswirkung der in Ihrem Genom vorhandenen genetischen Varianten auf das zu bewertende Merkmal.

Ein Nachteil aller Sportarten ist die Möglichkeit von Verletzungen. Aber dank Ihrer genetischen Informationen können wir Ihre Neigung zu bestimmten Verletzungen erkennen und Ihnen helfen, diese so intestine wie möglich zu vermeiden. Ein wichtiger Aspekt ist die bewusste Auswahl der Lebensmittel.

Mithilfe der Erkenntnisse aus dem Gentest kannst du

gezielt Produkte wählen, die deinem Körper guttun. Wenn

zum Beispiel deine genetische Analyse zeigt, dass dein Körper Schwierigkeiten hat, bestimmte Vitamine aufzunehmen, kannst

du bewusst auf Lebensmittel setzen, die diese in bioverfügbarer Type enthalten.

Reagieren Menschen anders auf Essen an sich oder bestimmte Nährstoffe?

Gerade letztere Variante spielt den neuen Anbietern,

die Gentests für den Konsumentenbereich anbieten, in die Karten. Gentests erscheinen einem als ein neuer Heilsbringer in der Fitness-

und Ernährungsbranche. Die Ergebnisse sagen einem, was für ein Gentyp man ist.

Geringfügige Änderungen können sich ergeben, wenn die Berechnungsmodelle entsprechend den neuesten wissenschaftlichen Studien aktualisiert werden. Dieser Take A Look At bestimmt das genetische

Profil einer Individual und gibt Aufschluss über ihr

sportliches Potenzial sowie über Präventionsmaßnahmen und

Bedürfnisse im Zusammenhang mit der sportlichen Betätigung.

Er liefert auch Informationen über den Nährstoffbedarf und Empfindlichkeiten. Die Identifikation von Kindern, die über diese Gene

verfügen, mit Hilfe von Gentests, könnte dabei helfen zukünftige olympische Champions zu

entwickeln. “Das Ziel des tellmeGen DNA-Test ist es, dass jeder Mensch von überall auf der Welt mit einem Gerät über das Internet Zugang zu seinen genetischen Informationen hat, um diese mit seinem Arzt teilen zu können”.

All diese Faktoren sollten Sie berücksichtigen,

um Ihre sportlichen Leistungen nicht zu schmälern und sie zur

weiteren Steigerung Ihrer positiven Fähigkeiten zu nutzen.

Genetisch gesehen ist es möglich, eine größere Veranlagung zu haben, um effektiver auf körperliche Betätigung zu reagieren.

Denn gesünder leben mit personalisierter Ernährung über einen Gentest ist

kein bloßer Development, sondern ein Konzept, das Wissenschaft und Wohlbefinden vereint.

Entdecke, wie du durch eine gezielte Kombination aus genetischer

Analyse und einfacher, effektiver Optimierung deinen Körper und

Geist in Bestform bringst! Nur 10–25 % deines Potentials werden durch deine Gene bestimmt – den Rest bestimmst du selbst.

Erfahre, wie du mit unserer Unterstützung das Beste aus dir

herausholst, basierend auf deiner einzigartigen Genetik.

Bisher kann ich essen, was ich möchte, weiß aber jetzt, dass ich mich aufgrund meines genetischen Musters auch in Zukunft bei den meisten Lebensmitteln nicht einschränken muss.

Liefert Informationen über die genetische Veranlagung

zur Entwicklung von Erkrankungen des Nervensystems und psychischen Störungenwie Alzheimer,

Parkinson, Schizophrenie, bipolare Störungen und Zwangsstörungen,

um nur einige zu nennen. Dies unterstützt eine mögliche Frühdiagnose und Vorbeugung dieser Krankheiten, was präzisere

und individuellere Interventionen für Verbesserung der Lebensqualität der Patienten. Werden Sie weitermachen, ohne zu wissen, wie Ihr

Körper auf körperliche Aktivität reagieren könnte? Mit dem ADNTRO DNA

Package Sportbericht, kannst du es endlich herausfinden und passe dein Training an. Defekte Beta-Zellen und damit verbundene

Insulinresistenz können beispielsweise bei einem Insulinom – einer Krebserkrankung der Bauchspeicheldrüse – Fettleibigkeit erzeugen.

Dies geschieht über eine Überregulation von Insulin durch den Tumor.

Es gibt ebenso ein paar genetische Faktoren, die durch einen Gendefekt zu einer solchen Entwicklung

beitragen können.

Wir wissen, wie Ihre Muskelregeneration nach dem Coaching

aussieht. Alternatives and challenges in nutrigenetics/nutrigenomics and well being.

Bei Anbietern, bei denen medizinische Aussagen (z.B.

über Krankheiten) gemacht werden, muss ein Arzt dieser zustimmen. Der Apothekerverband fordert

jedoch, dies künftig auch zu dürfen. Sofern es «nur» um Abstammung geht

oder allgemeine Aussagen zu Trainings- oder Ernährungstyp gemacht werden, geht eine Bestellung

auch ohne.

Gleichzeitig hilft dir ein personalisierter Ansatz dabei, problematische Lebensmittel

zu meiden, die möglicherweise unfavorable Auswirkungen auf deinen Stoffwechsel haben. Unsere Gene spielen eine entscheidende Rolle in nahezu jedem Aspekt unseres Lebens, von unserer

Körpergröße bis hin zu unserer Anfälligkeit für bestimmte Krankheiten. Doch die Einflüsse der Genetik reichen noch viel weiter.

Forschungsergebnisse zeigen, dass unsere genetische Veranlagung auch bestimmt, wie unser

Körper auf verschiedene Nahrungsmittel reagiert.

Ein einfaches Beispiel ist die Laktoseintoleranz, bei

der die Fähigkeit, Milchzucker zu verdauen, genetisch

bedingt ist. Geneventure gewährleistet die Vertraulichkeit aller personenbezogenen Daten und

Testergebnisse in Übereinstimmung mit der DSGVO.

References:

testosteron enantat erektionsprobleme

These embrace sport, a nutritious diet, a stable way of life, a standard

body weight and particular dietary dietary supplements (e.g.

zinc, ashwaghanda, vitamin D). Even if you finish up older,

a healthy diet, regular exercise, a solid way of life

and a standard physique weight are the necessary thing to preserving or increasing testosterone levels at

normal ranges. In addition, targeted measures, corresponding to

taking zinc or ashwagandha, also can stimulate testosterone ranges.

When it involves the query of how many onions a day you should consume to increase testosterone, it’s important to do not forget that moderation is vital.

That being said, incorporating a average amount of

onions into your day by day food regimen can have a positive impression in your

testosterone ranges. Firstly, cruciferous vegetables similar to

broccoli, cauliflower, and cabbage are recognized to contain a compound referred to as indole-3-carbinol,

which can help regulate estrogen levels within the physique.

These side effects could include digestive points, dangerous

breath, physique odor, and the potential for weight acquire if consumed excessively.

As at all times, it is suggested to seek the advice

of with a healthcare professional before making any vital modifications to your diet or life-style, particularly in case you have any pre-existing well being situations

or concerns. Schedule your free TRT session right here to uncover the reality about onions and testosterone, and to obtain professional advice on reaching optimum hormonal balance.

Consulting with healthcare professionals can provide personalised insights and techniques tailor-made to your particular person well being needs.

Nevertheless, it’s important to note that a well-balanced food plan, exercise, and a healthy lifestyle general are crucial for sustaining optimal hormone ranges.

In conclusion, onions can doubtlessly enhance testosterone ranges due to their quercetin content material.

Nevertheless, consuming onions alone may not be enough to cause a

significant increase in testosterone levels.

In addition to particular foods, sure supplements have also been studied for his or her

potential to extend testosterone ranges. Fenugreek is an herb that has

been historically used for various well being benefits, together

with enhancing libido and testosterone ranges.

A Quantity Of studies have proven that fenugreek can indeed improve testosterone

levels in men. Nevertheless, more analysis is required to fully understand its mechanism of motion and its long-term results.

Onions are known for their pungent scent and flavor, however in addition they comprise several well being benefits.

One potential good factor about consuming onions is that

they may assist improve testosterone levels.

Testosterone is a hormone that plays a vital position in the improvement of male reproductive tissues and secondary sexual traits.

Men can incorporate onions in any kind into their diets for the well being advantages,

as nicely as the chance of slightly boosting Testosterone.

In Addition To giving your testosterone a boost,

onions pack quite a punch with their high quercetin ranges, bringing alongside numerous health benefits.

If you’re eating fruits, greens, legumes and seeds, you’re doubtless

consuming plant estrogen — a group of naturally occurring compounds that may act like a weaker

form of the feminine sex hormone. Your body naturally makes them during normal processes like turning food

into power. But too many free radicals, especially from

outside sources (like smoking, UV exposure, or fried foods),

can cause a condition called oxidative stress. Over time, oxidative stress has been linked

to inflammation, aging, heart illness, and sure kinds of most cancers.

Whereas onions haven’t been extensively studied in relation to testosterone, there are some compounds and vitamins

in onions which will play a role in hormone regulation.

It can be concerned in the regulation of temper, power ranges, and total

well-being in each men and women. Onions include flavonoids, which are pure

compounds which have been shown to have a positive impact on testosterone ranges.

These flavonoids work by inhibiting the aromatase enzyme,

which converts testosterone into estrogen. By blocking this enzyme, onions may help to maintain larger ranges of testosterone within the body.

Another compound that has been identified in onions and

will play a task in stimulating testosterone production is

allicin. It has been found to have anti-inflammatory and antioxidant properties and has

also been studied for its potential to lower cholesterol levels and scale back the danger of heart problems.

It Is at all times advisable to consult with a healthcare skilled before making any main dietary adjustments or relying solely

on food sources for testosterone help. Onions

are a common staple in many cuisines, and so they have lengthy

been believed to have varied health advantages. Testosterone is a hormone that performs a vital function in the growth of male reproductive tissues and the promotion of secondary sexual traits, such as

increased muscle mass and bone density. Nevertheless, the

scientific proof behind this claim is proscribed, and the precise quantity of onion consumption required

to have an result on testosterone ranges is not nicely understood.

“There is a fable that individuals with breast cancer should keep away from soy, but the research truly exhibits that soy consumption may very well reduce the danger of death from breast cancer,” Rizzo notes.

The only reason to avoid food with phytoestrogen is that if a person is allergic to it, Rizzo says.

The official name is phytoestrogen, an “estrogen-like substance” found in some

crops and plant products that may have anticancer results,

based on the Nationwide Cancer Institute.

This gradual decline can result in varied well being issues,

similar to decreased muscle mass, reduced bone density,

and a decrease sex drive. Pink onions, specifically, have

the very best levels of antioxidants, however all onions include helpful compounds.

And because onions are easy to add to meals—raw in salads, caramelized on burgers, roasted with greens, or blended into soups—they’re a easy way to sneak extra well being benefits into

your day. Cooking onions does not considerably have an effect on their

potential testosterone-boosting results, because the

compounds answerable for these effects are relatively

stable to heat. Nonetheless, it could be very important

note that overcooking onions might lead to a loss of nutrients, so it’s best to

cook them lightly or eat them raw if possible.

One compound present in onions which will have a positive impact on testosterone ranges

is quercetin. It has been proven to have numerous well being benefits, including potential results on testosterone ranges.

One study printed within the Journal of Food Science in 2012 evaluated the results of certain onion compounds on testosterone manufacturing in rats.

The researchers discovered that the quercetin and quercetin glycosides in onions probably

contributed to increased serum testosterone ranges.

References:

anabolic steroids info (Nam)

facebook business manager for sale https://buy-business-manager-acc.org/

facebook bm for sale buy facebook verified business manager

buy facebook verified business account buy-verified-business-manager-account.org

buy facebook bm buy-verified-business-manager.org

Hormonal shifts would possibly bring on PMS or PMDD symptoms

like mood swings, anxiousness and despair. Whereas the pill itself doesn’t hasn’t been found to impression fertility, it’d masks health situations like

PCOS or endometriosis that might affect conception. This typically occurs within the second half

of your cycle—the luteal phase—before your period and after

ovulation. This is the time to be kind to your self, and understand that you are steroids a drug (jobs.Quvah.com) not your thoughts, and

they will pass. Your hormones also significantly control your mood and coming off the pill may cause emotional and psychological effects too.

Testosterone may lower some of that fatty tissue distribution around the

breasts, but probably not all of it, and the glandular and

ductal tissues which have already developed will stay as properly.

Earlier Than we delve into that question, you will want to

understand the process of voice change that happens with testosterone remedy.

Sometimes, the vocal folds in AFAB individuals are shorter and

thinner than these in individuals assigned male at birth (AMAB).

Testosterone therapy encourages the vocal folds to bear hypertrophy, leading to an increase in mass and size.

This development causes the voice to turn into deeper, more resonant, and nearer to the everyday male range.

It’s important to work with a speech therapist or vocal coach experienced in working with transgender

individuals to facilitate the voice change course of and

ensure the improvement of wholesome talking habits.

These results can additionally be exacerbated when you

have a psychological well being diagnosis like bipolar

dysfunction, he says. By implementing these methods, individuals can support their mental wellness and navigate the post-TRT section with larger resilience and positivity.

Some individuals use different medication to counteract the side effects of steroids, “cycle”

their use with breaks for “recovery” or “pyramid” use by steadily growing intake to a

peak and lowering again.

At AlphaMD, our endocrine specialists provide structured plans for sufferers who wish to cease, making certain a safe and wholesome transition off

the therapy. To immediately tackle the priority,

“once you start testosterone remedy, can you stop?” the

reply is sure, with caveats. Stopping TRT is feasible, but it involves a

strategic approach to ensure your body’s pure hormone manufacturing

isn’t adversely affected. In some cases, testosterone ranges may

not absolutely return to normal after finishing a cycle.

Nonetheless, that is extra frequent in people who have abused or improperly used testosterone or other anabolic steroids.

Use of this online service is topic to the disclaimer and the

phrases and situations. Testosterone therapy just isn’t beneficial while breastfeeding, as it could cross via breast milk

and may have an effect on the infant’s improvement.

Talk About alternatives and the timing of therapy with your healthcare supplier if you are

breastfeeding. Testosterone remedy can significantly cut back fertility, but it is nonetheless potential to become pregnant whereas undergoing treatment.

If you may be on testosterone remedy and do not wish to turn out to be pregnant, it is essential to make use of contraception.

The safest method is to avoid testosterone remedy during

pregnancy or consult with your physician if you need to remain on therapy.

By working intently along with your healthcare supplier, you’ll be able to minimize the risks to your child and

guarantee the healthiest potential pregnancy. More research is needed to completely perceive

the effects of testosterone therapy on fetal improvement and start outcomes.

Physicians have raised issues that TRT could cause prostate cells to develop,

however there has not been enough evidence to confirm this declare officially.

Your higher possibility is to speak to your physician and categorical your issues to allow them to stroll you through the process and figure out tips on how to increase your testosterone levels.

It should take about more than a month that you will expertise enchancment in your T ranges.

Men who require a minor testosterone increase report that their low T signs enhance in a couple

of days. However many healthcare professionals have

asserted that patients will see effective results from

TRT in two or 4 weeks.

They might embrace sipping herbal tea, taking a shower, performing some light

studying, stretching, or meditating. Sleep in a totally darkish room,

and avoid all light-emitting electronics (TV, laptop, cellphone) for

2 hours earlier than mattress. “Is my period ever going to come back back?” Amanda

requested during our initial session. Some people may need TRT for a very lengthy time, whereas

others might only want it for a brief period.

Additionally, testosterone may alter the lining of the uterus, making it

harder for an embryo to implant and develop, additional decreasing fertility.

Testosterone remedy isn’t sometimes recommended for

folks with regular testosterone ranges as a end result of it can trigger unwanted side effects, such as elevated danger of heart

disease, blood clots, and other well being issues. Subsequently, it’s necessary that anyone considering testosterone therapy endure a full medical

analysis and work intently with their doctor to make sure the therapy

is protected and essential.

facebook bm account buy https://business-manager-for-sale.org/

unlimited bm facebook https://buy-business-manager-verified.org

buy facebook business manager accounts facebook verified business manager for sale

buy facebook business manager accounts verified-business-manager-for-sale.org

verified business manager for sale buy-business-manager-accounts.org

tiktok ads account for sale https://buy-tiktok-ads-account.org

buy tiktok ads account https://tiktok-ads-account-buy.org

tiktok ad accounts https://tiktok-ads-account-for-sale.org

tiktok ads agency account https://tiktok-agency-account-for-sale.org

buy tiktok business account https://buy-tiktok-ad-account.org

tiktok ads account buy https://buy-tiktok-ads-accounts.org

70918248

References:

mental health cases in steroid abuse|acybgntbgv0jfnkoyks0e75iu3dejdmsdw:*** (https://www.google.co.uz/url?q=https://heavenarticle.com/author/lauragirl94-3087070)

buy tiktok ads account https://buy-tiktok-business-account.org

buy tiktok business account https://buy-tiktok-ads.org

tiktok agency account for sale https://tiktok-ads-agency-account.org

https://oboronspecsplav.ru/

Лесно съчетание и винаги перфектна визия с готовите дамски комплекти

дамски комплекти https://komplekti-za-jheni.com/ .

Актуални дамски комплекти, които съчетават удобство и модерна визия

дамски комплекти с намаление komplekti-za-jheni.com .

Пансионаты Гагр с видом на море и полным комплексом удобств

гагры отдых у моря https://www.otdyh-gagry.ru/ .

Lentalife — онлайн-журнал о том, как стать счастливее и увереннее в себе. На сайте https://lentalife.com/ вы найдёте практичные советы по улучшению качества жизни, психологию, здоровье и вдохновляющие жизненные истории.

70918248

References:

bad effects of steroids, http://www.Pinnacleatbigsky.com,

Kaliteden ödün vermeyenler için özel seçilmiş full hd film yapımları

ultra hd film izle https://www.filmizlehd.co .

70918248

References:

bodybuilding steroids side effects (https://topic.lk/13637/)

70918248

References:

Androgenic vs anabolic – hdlivethrill.com,

Алкоголь с доставкой прямо к двери — просто оформите заказ онлайн

доставка алкоголя на дом москва доставка алкоголя 24 часа москва .

70918248

References:

where can you buy legal steroids (http://vault106.tuxfamily.org/index.php/post/%5BVAULT023%5D-Audio-Failed-Noise-Miracle-Surface)

70918248

References:

none (https://pbs-Marketing.de)

70918248

References:

Nh Casino Vote; Guardian.Ge,

70918248

References:

None (Metamiceandtravel.Com)

На сайте https://relomania.com оставьте заявку для того, чтобы воспользоваться высококлассными, профессиональными услугами популярной компании «Relomania», которая поможет вам притворить в жизнь любые планы, в том числе, если вы решили инвестировать в недвижимость либо приобрести дом для отдыха. Вам будет оказано комплексное содействие в выборе и приобретении автомобиля. Эта компания вызывает доверие из-за того, что она надежная, обеспечивает поддержку. Воспользуйтесь бесплатной консультацией.

minitinah onlyfans leaks are trending today! Find out why minitinah leaks are all over the web. minitinah fapello is packed with high-quality videos. This minitinah fuck tape is the talk of the town.

https://t.me/MiniTinahOfficial All @minitinah nude leaks are now collected online. Uncut, uncensored — minitinah full video inside. Full minitinah sex scene online and uncensored. Best content ever from minitinah OnlyFans revealed. Massive leak: minitinah full nude pics & vids.

Бездепозитный бонус в казино Бездепозитные бонусы

автоломбарды адреса

24avtolombard-pts65.ru/ekb.html

кредит под залог авто с плохой кредитной

Новадент – стоматологическая клиника, которая современным оборудованием оснащена. Используем материалы высокого качества и действенные обезболивающие средства. Мы лучезарные улыбки дарим! Вы узнаете, с чего начинается процесс лечения у стоматолога. https://novadentspb.ru – тут отзывы о нас представлены, посмотрите их в любое время. На сайте можете оставить контактный номер, и мы в ближайшее время обязательно перезвоним вам. Наши врачи повышают навыки регулярно. Они уважают пациентов и свою работу любят. За доверие к клинике Новадент мы признательны!

Norma ISO 10816

Sistemas de equilibrado: fundamental para el funcionamiento fluido y productivo de las equipos.

En el entorno de la avances actual, donde la rendimiento y la seguridad del dispositivo son de gran trascendencia, los aparatos de ajuste tienen un funcion vital. Estos sistemas adaptados estan disenados para equilibrar y fijar elementos rotativas, ya sea en equipamiento de fabrica, transportes de desplazamiento o incluso en electrodomesticos domesticos.

Para los especialistas en conservacion de aparatos y los tecnicos, trabajar con dispositivos de balanceo es fundamental para proteger el desempeno suave y confiable de cualquier aparato rotativo. Gracias a estas alternativas innovadoras innovadoras, es posible limitar sustancialmente las sacudidas, el zumbido y la carga sobre los rodamientos, aumentando la vida util de componentes caros.

De igual manera significativo es el papel que juegan los equipos de equilibrado en la servicio al usuario. El asistencia especializado y el mantenimiento continuo utilizando estos sistemas facilitan ofrecer prestaciones de gran calidad, elevando la satisfaccion de los consumidores.

Para los responsables de proyectos, la financiamiento en estaciones de equilibrado y dispositivos puede ser esencial para optimizar la eficiencia y productividad de sus dispositivos. Esto es especialmente importante para los empresarios que gestionan medianas y pequenas emprendimientos, donde cada punto cuenta.

Por otro lado, los dispositivos de calibracion tienen una amplia uso en el area de la proteccion y el monitoreo de excelencia. Permiten encontrar probables fallos, evitando mantenimientos caras y averias a los dispositivos. Tambien, los indicadores generados de estos equipos pueden emplearse para maximizar metodos y incrementar la visibilidad en motores de exploracion.

Las zonas de implementacion de los aparatos de equilibrado comprenden variadas sectores, desde la produccion de transporte personal hasta el control ecologico. No afecta si se considera de grandes fabricaciones manufactureras o pequenos espacios hogarenos, los dispositivos de calibracion son esenciales para proteger un desempeno optimo y libre de detenciones.

Изучите актуальные и полезные новости на тему финансов, а также недвижимости. Все самые содержательные данные с финансовых рынков Польши и всего мира в одном месте. Здесь огромное количество материалов, которые получены из достоверных источников, поэтому на них точно можно положиться. https://newsfin.pl/ – на сайте опубликованы и фотографии, которые помогут лучше понять то, какая ситуация происходит в мире. Представлены материалы на тему криптовалюты, экономики, бизнеса. Заходите сюда регулярно, чтобы получить достоверную информацию.

https://russiamarkets.to/

https://russiamarkets.to/

https://briansclub.bz/

https://briansclub.bz/

Chicken Road: Honest User Opinions

Chicken Road is an arcadestyle gambling game that has caught the attention of players with its simplicity, high RTP (98%), and unique cashout feature. By analyzing user opinions, we aim to figure out whether this game deserves your attention.

Key Highlights According to Players

Many users praise Chicken Road for its fastpaced gameplay and ease of use. The option to withdraw winnings whenever you want introduces a tactical element, and the high RTP ensures it feels more equitable compared to classic slots. The demo mode is a hit with beginners, allowing players to test the game riskfree. Players also rave about the mobilefriendly design, which performs flawlessly even on outdated gadgets.

Melissa R., AU: “Unexpectedly enjoyable and balanced! The ability to cash out brings a layer of strategy.”

Nathan K., UK: “The arcade style is refreshing. Runs smoothly on my tablet.”

Players also enjoy the colorful, nostalgic design, which feels both fun and engaging.

Criticisms

However, Chicken Road isn’t perfect, and there are a few issues worth noting. Some players find the gameplay repetitive and lacking depth. Players also point out unresponsive support teams and insufficient features. One frequent criticism is deceptive marketing, as people thought it was a pure arcade game rather than a gambling platform.

Tom B., US: “Fun at first, but it gets repetitive after a few days.”

Sam T., UK: “Advertised as a fun game, but it’s clearly a gambling app.”

Advantages and Disadvantages

Positive Aspects

Easytounderstand, quick gameplay

An RTP of 98% guarantees a fair experience

Practice mode to explore without financial risk

Seamless operation on smartphones and tablets

Negative Aspects

It might feel too predictable over time

Limited variety and features

Delayed responses from support teams

Confusing promotional tactics

Final Verdict

Thanks to its transparency, high RTP, and userfriendliness, Chicken Road makes a mark. Perfect for relaxed gaming sessions or newcomers to online betting. That said, its focus on chance and limited depth might not satisfy all players. To maximize enjoyment, stick to authorized, regulated sites.

Rating: 4/5

A balanced blend of fun and fairness, with potential for enhancement.

equilibrado de ejes

Equipos de calibracion: clave para el funcionamiento uniforme y efectivo de las dispositivos.

En el entorno de la ciencia moderna, donde la eficiencia y la fiabilidad del sistema son de alta trascendencia, los dispositivos de ajuste tienen un papel vital. Estos dispositivos especificos estan creados para ajustar y regular partes dinamicas, ya sea en maquinaria productiva, automoviles de movilidad o incluso en electrodomesticos domesticos.

Para los profesionales en mantenimiento de dispositivos y los tecnicos, manejar con sistemas de equilibrado es crucial para garantizar el funcionamiento fluido y fiable de cualquier dispositivo movil. Gracias a estas soluciones tecnologicas modernas, es posible minimizar considerablemente las vibraciones, el zumbido y la tension sobre los soportes, mejorando la vida util de componentes valiosos.

Igualmente importante es el rol que tienen los aparatos de calibracion en la atencion al comprador. El ayuda especializado y el reparacion regular utilizando estos sistemas posibilitan dar soluciones de gran excelencia, aumentando la satisfaccion de los compradores.

Para los responsables de emprendimientos, la financiamiento en equipos de calibracion y detectores puede ser esencial para incrementar la productividad y productividad de sus equipos. Esto es especialmente significativo para los duenos de negocios que manejan reducidas y modestas empresas, donde cada elemento es relevante.

Ademas, los equipos de balanceo tienen una amplia implementacion en el campo de la fiabilidad y el gestion de nivel. Habilitan identificar potenciales errores, reduciendo reparaciones onerosas y averias a los sistemas. Incluso, los datos obtenidos de estos aparatos pueden utilizarse para mejorar procesos y incrementar la reconocimiento en plataformas de busqueda.

Las sectores de uso de los aparatos de equilibrado incluyen multiples ramas, desde la fabricacion de ciclos hasta el control de la naturaleza. No interesa si se trata de grandes fabricaciones industriales o reducidos establecimientos hogarenos, los aparatos de balanceo son necesarios para promover un funcionamiento efectivo y sin interrupciones.

Компания Mikrotik широко известна в сфере сетевых технологий. Она предлагает широкий ассортимент маршрутизаторов и точек доступа. Эти устройства зарекомендовали себя благодаря своей надежности и производительности.

Операционная система RouterOS, установленная на устройствах Mikrotik, является одним из основных достоинств. RouterOS предоставляет пользователям возможность настраивать маршрутизаторы через удобный интерфейс. С помощью RouterOS доступны различные функции, такие как VPN, брандмауэр и QoS.

Настройка оборудования Mikrotik может показаться сложной для новичков. Тем не менее, благодаря большому количеству обучающих ресурсов и форумов, овладеть RouterOS вполне возможно. Можно найти видеоуроки, статьи и даже курсы, которые детализируют процесс настройки.

Таким образом, Mikrotik представляет собой надежное решение для самых различных сетевых потребностей. Доступные цены и широкий функционал делают его популярным среди специалистов. Независимо от того, требуется ли вам домашняя сеть или сложное бизнес-решение, Mikrotik справится с задачами.

WiFi точка доступа MikroTik [url=http://mikrotikwarehouse.ru/product-category/radiomosty-i-tochki-dostupa/]http://mikrotikwarehouse.ru/product-category/radiomosty-i-tochki-dostupa/[/url]

На сайте https://rubikonexpert.ru почитайте содержательную и нужную информацию, которая касается центра судебной экспертизы «РУБИКОН». В компании работают лучшие специалисты с большим опытом. Они отлично знакомы со всеми нюансами работы. Предприятие давно и плодотворно сотрудничает с государственными органами. Экспертизы проводятся в ограниченные сроки, но интервал зависит от различных факторов, в том числе, нужно ли выезжать на объект, а также количества специалистов, которые будут участвовать в процессе.

buy fb account accounts market purchase ready-made accounts

АвтоМастера.нет – портал, на котором актуальная информация представлена. Вы узнаете, что такое чип-тюнинг. Расскажем, какая лучше трансмиссия. Собрали советы, которые будут полезны при эксплуатации и вождении машины. Разберемся в том, как работает датчик кислорода. Ищете кондиционер лансер? Avtomastera.net – тут автомобильные мастера разъясняют о тонкостях работы с клиентами, машинами, также механизмами. На сайте имеется поиск, примените его. Руководствуясь нашими рекомендациями, вы сможете оптимальное время замены масла определить.

поставщики подшипников в россии Смазка подшипников Смазка подшипников – это необходимое условие для снижения трения, износа и обеспечения длительного срока службы.

Thanks for the article. Here’s more on the topic https://remonttermexov.ru/

Полная уборка квартиры генеральная проводится командой опытных клинеров. Мы берёмся за любые объёмы и гарантируем качественный результат.

Процесс генеральной уборки представляет собой важное мероприятие в жизни любой семьи. Она помогает создавать чистоту и комфорт в доме.

Для успешной генеральной уборки необходимо составить план. В первую очередь, нужно установить, какие зоны вы хотите убрать. Такой подход позволит избежать хаоса.

Кроме того, важно подготовить необходимые средства. Чистящие средства, тряпки и пылесос — это основные вещи. Хорошая подготовка позволит сэкономить время.

После того, как все подготовлено, стоит приступать к уборке. Сосредоточьтесь на одной комнате за раз. Так будет легче увидеть результаты своих трудов.

Ищете промышленные станки чпу с доставкой? Заходите на портал Interaktivnoe-oborudovanie.ru/catalog/stanki-s-chpu/ и у вас появится прекрасная возможность по доступной стоимости приобрести станки с ЧПУ. Ознакомьтесь с нашим приличным выбором по наилучшим ценам. Осуществляем доставку по всей России. Для каждого станка с ЧПУ вы найдете подробные характеристики и описание. Мы для бизнеса предлагаем надежное и лучшее оборудование.

blackjack strategy trainer

References:

https://Paramedical.sureshinternationalcollege.In

do steroids help you lose weight

References:

guardian.ge

growth hormone vs steroids

References:

paramedical.sureshinternationalcollege.in

anabolic steroid deca

References:

paramedical.sureshinternationalcollege.in

Advantageous offer https://vmtechnologies.in/wp-content/pages/vybor_stilynoy_mebeli.html .

Here is another site on the topic best books to read on kindle unlimited

Related article https://tione.ru/

maryland live virtual casino

References:

blackjack regles; https://i-tech.net.in/top-5-full-stack-frameworks-to-learn-in-2024,

steroids used for

References:

https://vcards.fennec-vision.com/

Wenn eine Person jedoch in kurzer Zeit Fett verlieren möchte, ist es wichtig,

die Produktion von hGH im Körper zu maximieren. Daher ist

es auch wichtig, das beste Wachstumshormon für das Bodybuilding zu bekommen.

Denken Sie daran, dass die Injektion von Wachstumshormonen ohne die Aufsicht und den Rat eines

Arztes zu Problemen führen kann. Das menschliche Wachstumshormon ist eine Substanz, die normalerweise vom menschlichen Stoffwechsel von der

Kindheit bis zur Pubertät produziert wird. Diese Peptidsubstanz trägt bis zum Ende der Pubertät zum Wachstum von Knochen und Geweben bei.

Sie wird von der Hirnanhangdrüse produziert und bei Bedarf an den Körper abgegeben. In den frühen 90er

Jahren war die einzige Möglichkeit zur Herstellung von hGH zu produzieren, bestand darin, es aus dem Gehirn menschlicher Leichen zu gewinnen.

Wie du siehst, ist das Wachstumshormon von äußerster

Wichtigkeit für uns Menschen. Im Umkehrschluss kann ein niedriger Wachstumshormonspiegel dafür sorgen, dass exakt die genannten Probleme auftreten. Es

schließt sich additionally die Frage an, wie hoch die Wachstumshormonproduktion bei einem gesunden Menschen sein sollte.

Das Wachstumshormon wird vom Organismus in der Hirnanhangdrüse, der sogenannten Hypophyse, produziert und

ist, wie der Name es bereits vermuten lässt, an Wachstumsprozessen im Körper beteiligt.

Dies betrifft in erster Linie sowohl das Zellwachstum als auch ganz allgemein die Regeneration.

Kortikotropin führt bei übermäßigem Gebrauch zum Abbau von körpereigenen Reserven (Zucker, Fett), zu Entzündungen und zu Infektionen. Kortikotropin reguliert die Produktion von Kortison und Kortisol

und kann anregend (euphorisch) wirken. Die natürliche Ausschüttung

erfolgt in einem Tag-Nacht-Rhythmus und es besteht ein negativer Zusammenhang

zu Kortisol.

Nichtsdestotrotz bleibt der Wachstumshormonspiegel

nicht über die gesamte Lebenszeit hinweg gleich, denn insbesondere im Rahmen der Pubertät erreicht die Hormonkonzentration im Blut bei

beiden Geschlechtern einen kräftigen Peak.

Dieser Peak hält in der Regel bis in die frühen Zwanziger, bis die Konzentration dann auf ein moderates Niveau heruntergefahren wird.

Wie schon oben erwähnt, vermindert das Wachstumshormon das

Körperfett und wirkt stark anabol, d.h. Ich halte es daher für ein Hormon, das prädestiniert ist, bei Männern eingesetzt zu werden (wenn es eine medizinische Indikation dafür gibt).

Wachstumshormone oder auch Somatropin genannt sind lebensnotwendige Hormone welche im menschlichen Körper gebildet werden. Sie erfüllen zahlreiche wichtige Aufgaben im Körper und werden im Gehirn im Vorderlappen der Hypophyse gebildet.

Eine HGH-Überproduktion führt im Kindes- und Jugendalter zu einem Hochwuchs, im Erwachsenenalter hingegen zu komplett

anderen Störungen, da das Längenwachstum

der Knochen abgeschlossen ist.

Verbesserter Schlaf hat mehr angeborene Vorteile als Sie sich vorstellen. Wenn Sie exogenes HGH injizieren, erhöht